⏩ TL;DR

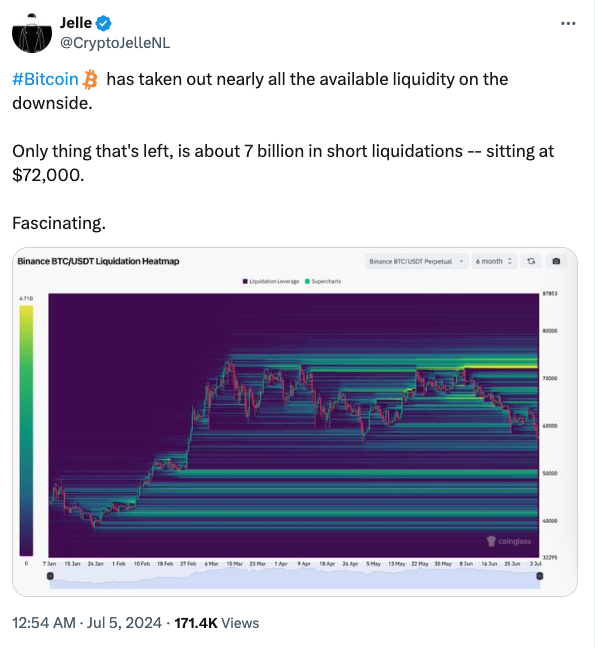

Bitcoin has dropped below its 200-day Moving Average, as selling pressure from Mt Gox and the German Government create doom and gloom in the markets.

📬 In This Issue

- Web3 Headlines – $BTC Plunge, crypto is not an election issue in the UK

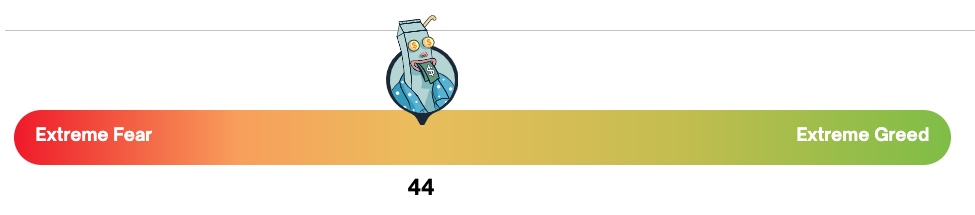

- Fear & Greed Index – 44

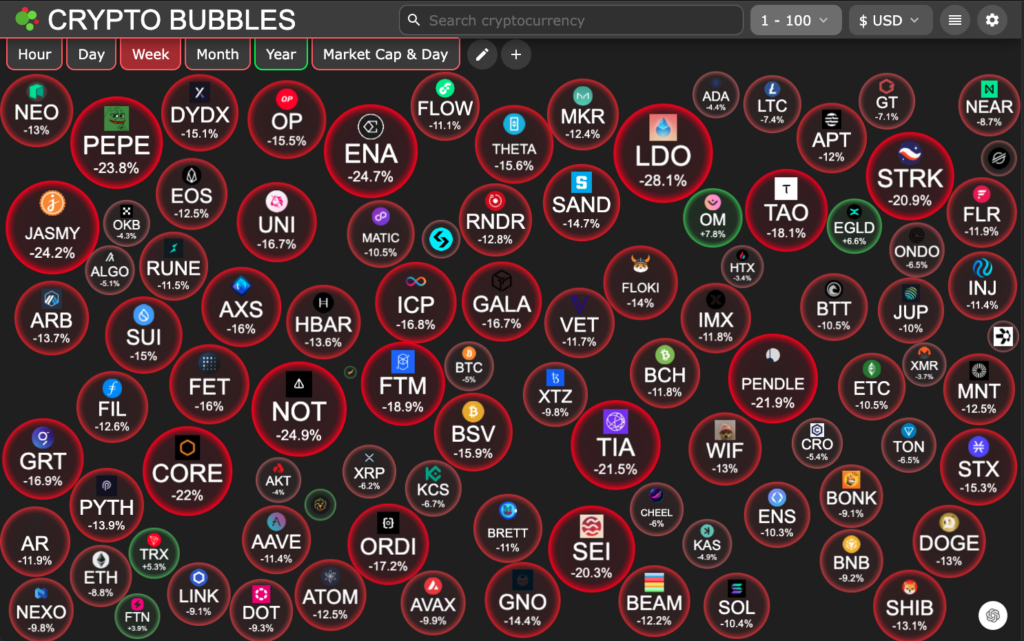

- Market Moves – Bearish for Top 100

- Expert Analysis – DCA Live & Trading the Close

- Dates To Watch – $ETH ETF, $ARB and $APTOS unlocks

- Top Tweets & Crypto Memes

💎 Sponsored by

This issue is sponsored by Milk Road, which is a much better newsletter than this one.

Subscribe to Milk Road here, and get their daily memes and in-depth analysis.

🗞️ Web3 Headlines

- Mt Gox wallets are sending text transactions to creditor repayment accounts – The Block

- German government sends another $75 million $BTC to exchanges – Decrypt

- Bitcoin has completed it’s pullback to $60,500, as predicted in the previous issue

- 10x Research predicts Bitcoin fall to $50k – CoinTelegraph

- In the UK’s first election in 5 years, parties remain silent on crypto – Coindesk

😱&💸 Fear & Greed Index

The Fear & Greed Index, according to Milk Road, measures the mood of the crypto market.

Subscribe to their excellent newsletter for daily crypto updates.

📈 Market Moves – Top 100

The market was 📉 Bearish 🐻 for the top 100 tokens.

- None of these tokens reached a 52-week high, Cosmos and Arbitrum reached a 52-week low.

- Biggest winner was $OM with a 7% gain on the week, and $LIDO was the biggest loser, down 28%.

Key Support Levels from Verified Investing

Earlier in the week, Gareth Soloway identified $60k, $56k, and $49k as key support levels on $BTC.

From his expert crypto analysis:

Positive And Negative Of Bitcoin

Positive – Bitcoin is being adopted by more and more people. Volatility is coming down which is a good thing. Ultimately, Bitcoin has the potential to be a digital gold. With a global debt crisis looming, Bitcoin could be a major store of value.

Negative – Bitcoin is still not that store of value and tends to trade like a risk asset. This means that if the stock market falls sharply, Bitcoin could also fall sharply. Considering the valuation in the stock market has reached stretched levels, Bitcoin does have risk over the next 12 months of going lower. Watch the $49,000-$50,000 level. if that breaks, $30,000 is a possible target.

from Bitcoin Chart Analysis with Key Support Levels by Verified Investing

🧐 Expert Analysis

[64:30] DCA Live: Bottom Is In? with CTO Larsson, InvestAnswers, & Mando

TL;DW Takeaways:

📈 Bitcoin held the $60k support level for a long time, indicating market strength.

🤔 Speculation exists that BlackRock and Michael Dell are accumulating Bitcoin, showing confidence in its value.

🚀 Solana maintained support levels, thanks to technical improvements and positive sentiment around new product launches and ETFs.

⚡ Tesla stock bounced back from key support levels, driven by new developments like the Cyber Cab patent and investor interest.

🌍 Political and regulatory changes, such as the EU’s MiCA and the US presidential election, are crucial factors influencing market sentiment and future crypto adoption.

[20:45] Verified Game Plan with Gareth Soloway

TL;DW Takeaways:

📊 Jerome Powell: Speech and JOLTS job data coming in to influence macro

🚗 Tesla: China shipments down 24%; delivery numbers out later today.

📉 European Markets: DAX and CAC show concerning patterns with global implications.

💰 Bitcoin: Resistance at 63K; potential move to 67K or down to 56.5K.

🛢️ Oil: Prices rise pre-July 4th; expected to pull back post-holiday.

[23:01] Finding Easy Invalidations for Strong Candle Closes with Technical Roundup

TL;DW Takeaways:

📉 BTC has been consolidating for four months; wait for a breakout or breakdown before trading.

🚫 Avoid over-trading tested levels; use closing prices as trade indicators.

📈 Focus on breakout trades at midpoints or highs of the range for BTC, ETH, and SOL.

🔍 Intraday trading targets BTC’s 63.3K resistance and weekly levels from 61.4K to 71.3K.

🕰️ Be patient, consider high time frame contexts, and ignore social media pressures to trade.

👀 Dates To Watch

- 12 July – US CPI m/m and unemployment claims numbers released

- 16 July – $ARB token will unlock $75 million for its team, advisors, and investors

- Aptos is unlocking 11.31 million $APT tokens worth $77 million

- Ethereum ETFs could come as soon as next week, according to Bitwise

𝕏 Crypto Twitter

😁 Crypto Memes

🛠️ Cool Tools

- TradingView, a charting platform and social network used by 60M+ traders

- LuxAlgo, the most powerful trading tools, signals, and alerts

- Ledger, a hardware wallet that lets you self-custody

- Wise, a multi-currency account that lets you safely transfer fiat internationally

- ExpressVPN, a Virtual Private Network that protects you from snooping, interference, and censorship

- MilkRoad, the best daily newsletter in crypto

- OKX, a secure and efficient crypto exchange

- EasyCrypto, a simple way to buy, sell and swap crypto in New Zealand

- RobinHood, an exchange to invest in crypto, stocks, and ETFs

- Hodl Hodl, a Global P2P Bitcoin trading platform that doesn’t hold funds

- Fold, a rewards debit card that pys 20,000 sats when you sign up and make a purchase

- Entre, the new professional network designed for the future of work.

If you have received value from this newsletter, using one of the affiliate links above is an easy way to show your support. At no cost to you, I may earn a commission if you click one.

❝ Investment Quote

“When dealing with people, remember you are not dealing with creatures of logic, but creatures of emotion.”

– Dale Carnegie

⚠️ Disclaimer

This is not financial advice, and the author, Caelan Huntress, is not a financial advisor, he’s just a dude on the internet. Do your own research, wipe your own nose, and read this newsletter for education and entertainment purposes only